palm beach county business tax receipt phone number

These fees are for the most common type of applications. Business tax email link.

Margate Area Broward County Local Business Tax Receipt 305 300 0364

Administrative Office Governmental Center 301 North Olive Avenue 3rd Floor West Palm Beach FL 33401 561 355-2264 Contact Us.

. When payment is received your local business tax receipt will be mailed to you. Home Occupation Business Tax Receipt Certificate of Compliance Form 103. Business tax email address.

West Palm Beach-Vista Center 561-233-5200. Applicants must apply with the Village of Royal Palm Beach and obtain Zoning approval PRIOR to applying for the Palm Beach County Business Tax Receipt. Business tax is regulated by Florida Statute Chapter 205 as.

Palm Beach County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Palm Beach County Florida. Business tax email address. For the current type able version of this form visit the PBC Zoning Web Page at.

Property Appraiser website link. Box 3353 West Palm Beach FL 33402-3353. Unincorporated - Palm Beach County Zoning Approval If business is located in unincorporated Palm Beach County submit this application to Palm Beach County Planning Zoning Building for approval 2300 N.

APPLICATION FOR PALM BEACH LOCAL BUSINESS TAX RECEIPT. The report also provides basic information about businesses or landlords ie address phone number contact person website address ownerpresidents name etc - if known. The online Business Information Reports contain information received by Palm Beach County County Consumer Affairs over the past 3 years.

Please refer to this number when making inquiries. I look forward to welcoming clients to this new location. Box 3353 West Palm Beach FL 33402-3353 3.

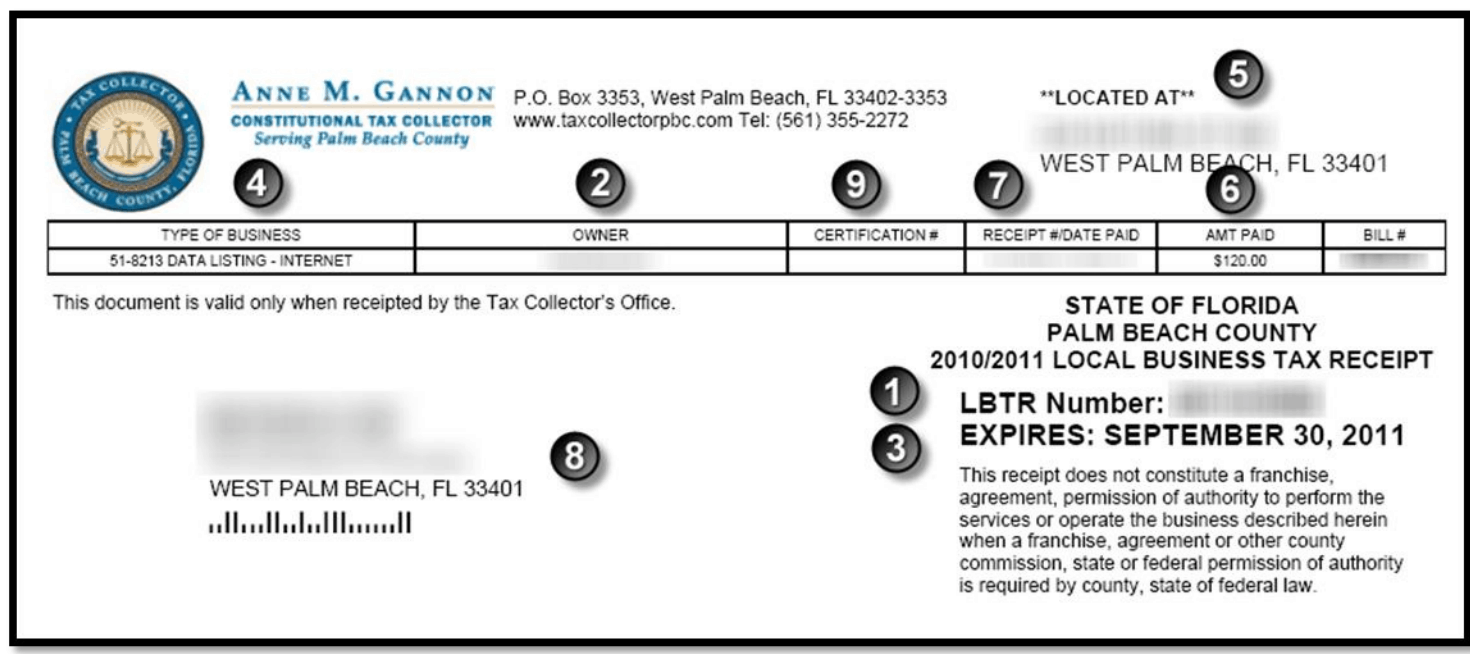

401 CLEMATIS STREET WEST PALM BEACH FLORIDA 33401 IF FAX OR EMAIL PLEASE ALLOW 7-10 BUSINESS DAYS FOR PROCESSING. This Tax Receipt expires on the date shown. A Zoning Confirmation Letter ZCL is a written response issued by the Zoning Division to make a determination of or clarify a Unified Land Development Code question.

YOU WILL BE CONTACTED VIA EMAIL WITH NEXT STEPS AND PAYMENT OPTIONS. 360 South County Road. Congress Ave Delray Beach 4215 S.

For specific businesses or if you are unsure please call 561-799-4216 for fee estimates. Business Tax Department PO. Olive Ave 3rd Floor West Palm Beach Governmental Center 3188 PGA Blvd Palm Beach Gardens 501 S.

Once the application has been processed a client service specialist will call to provide payment instructions 4. Palm Beach FL 33480. All businesses and professional offices within the Village must also obtain a Business Tax Receipt from Palm Beach County.

Please note that any business that opens or begins operating prior to obtaining an approved business tax receipt will be charged an additional penalty of 2500. Town of Palm Beach. Your Business Tax Receipt is issued subject to Palm Beach Gardens Code Section 78-159 1.

What is a Zoning Confirmation ZC Letter and how long does it take. Gannon Constitutional Tax Collector Serving Palm Beach County. If this is NOT correct contact the Tax Collectors office at 561 355-2272.

These records can include Palm Beach County property tax assessments and assessment challenges appraisals and income taxes. Location Before leasing space call the City of Palm Beach Gardens Planning and Zoning Department 561-799-4222 to determine if the site you have selected for your business is in the appropriate zoning district for your type of business. Their Lakeland Office telephone number is 863-499-2260.

Business tax is a tax you pay to the City for the privilege of doing business in the City. Palm Beach County Local Business Tax Receipt is in addition to not in lieu of any license required by law or municipal ordinance County Ordinance 72-7. Palm Beach County Zoning Division 2300 N.

PO Box 2029. Further information can be obtained by calling 561 355-2272 or visiting our website. Palm Beach County Tax Collector Attn.

Tax Receipt Sample. Please review this list before applying for your new Business Tax Receipt. Florida Sales Tax Number when applicable To obtain a Florida Sales Tax Number or resale number contact the Florida Department of Revenue.

Those seeking to obtain a county local business tax receipt can complete an application form and mail it in with the applicable payment due. You are required to complete the correct application see Forms pay fees and in most cases have inspections in order to comply and be issued a local business tax receipt formerly known as occupational license. Jog Road West Palm Beach Florida 33411 Phone.

I hereby apply for a Home Based Business Tax Receipt to use a business telephone listing business stationery and conduct minor business activity of a business office at my residence. We encourage you to go to the Countys website to find out more regarding your tax obligations. This new state of the art 23735-square-foot service center will replace the current facility in Royal Palm Beach and serve the western communities of our county.

This is a unique number assigned to each business. Constitutional Tax Collector Serving Palm Beach County PO. 200 Civic Center Way Royal Palm Beach FL 33411 Map If you are looking for additional information about Drivers License Renewals Auto Tag Renewals andor Registrations Handicap Permits HuntingFishing Licenses or any other County Tax related business OTHER THAN registering for a Business Tax Receipt please call 561 355-2264.

Unified Land Development Code Article 4B1E10 Home Occupation.

Tourist Development Tax Constitutional Tax Collector

Palm Beach County Local Business Tax Receipt 305 300 0364

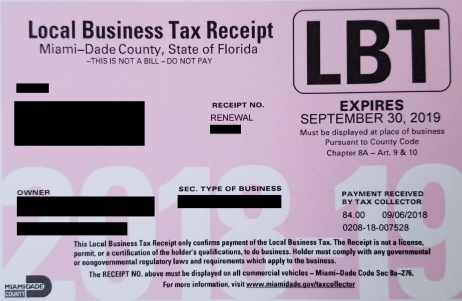

Miami Dade County Local Business Tax Receipt 305 300 0364